Amaze Mobile Banking Application

About Amaze Mobile Banking Application

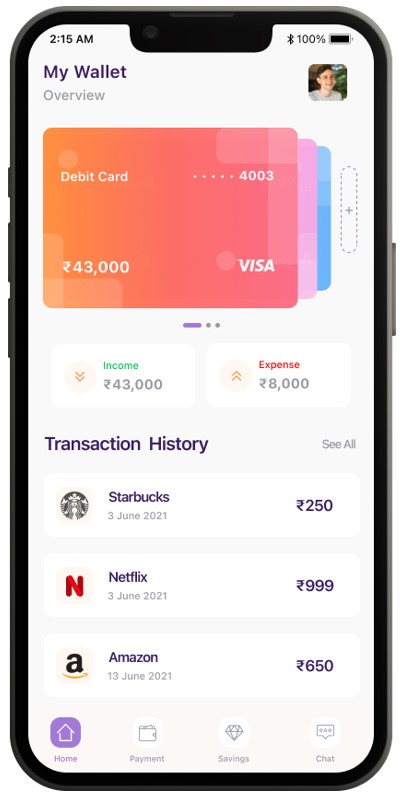

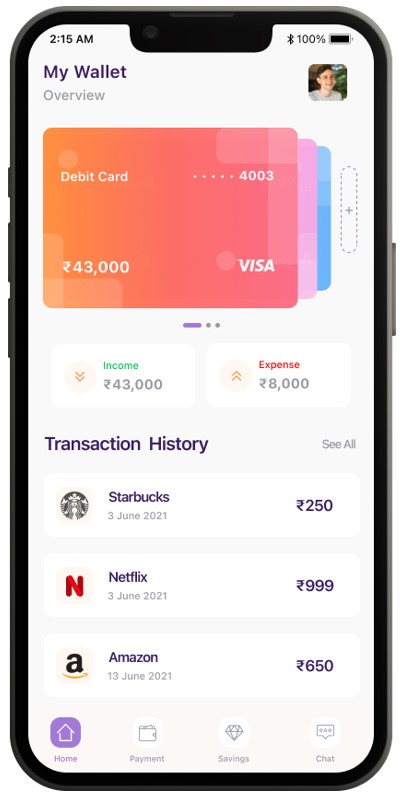

We are committed to delivering exceptional services that significantly enhance customer satisfaction. Our offerings include advanced card access, enabling users to effortlessly add and manage multiple cards, thereby optimizing their financial management. Users can also monitor recent transactions, facilitating precise tracking of their expenditures. Our platform provides streamlined payment solutions, simplifying the management of financial obligations.

Furthermore, we empower users to secure their financial future by establishing tailored monthly and yearly savings goals aligned with their specific plans. Our responsive customer support is readily available through various channels, including WhatsApp, ensuring that users receive timely assistance.

Please be advised that I am presenting the “Amaze Mobile Banking Application” as part of a project. Due to company policies, I am unable to disclose comprehensive details. Additionally, I cannot provide further elaboration on this content due to regulatory restrictions.

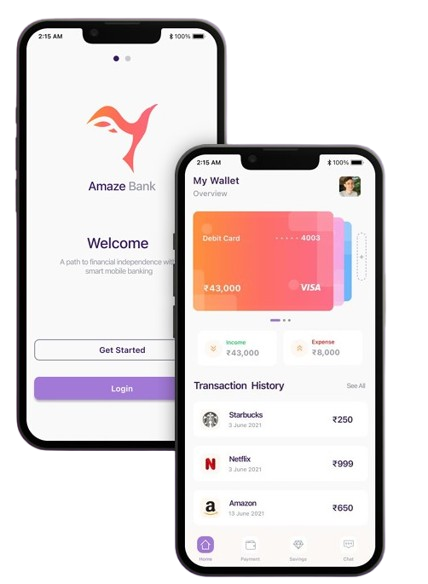

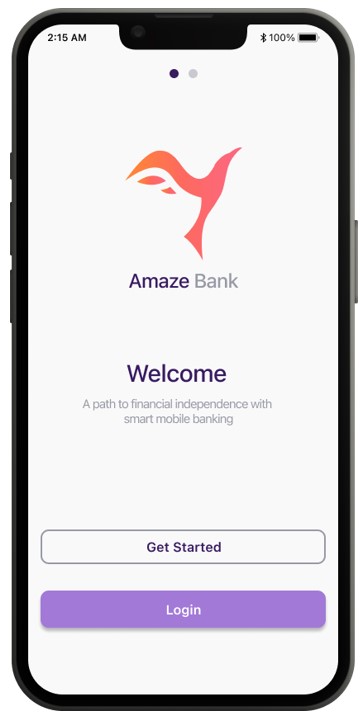

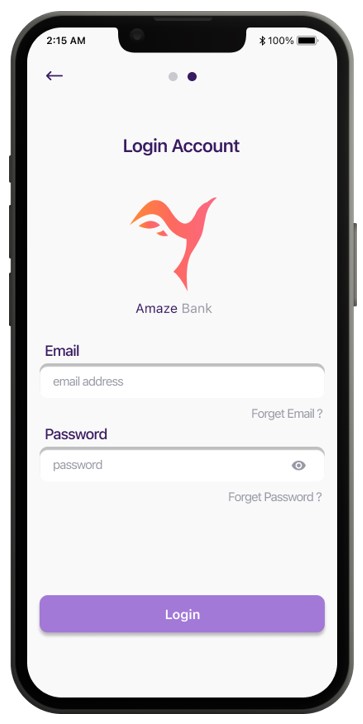

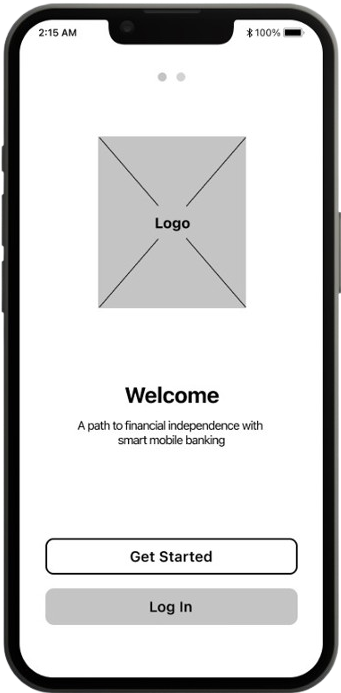

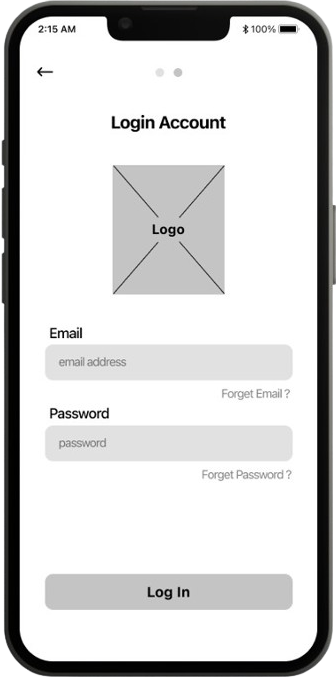

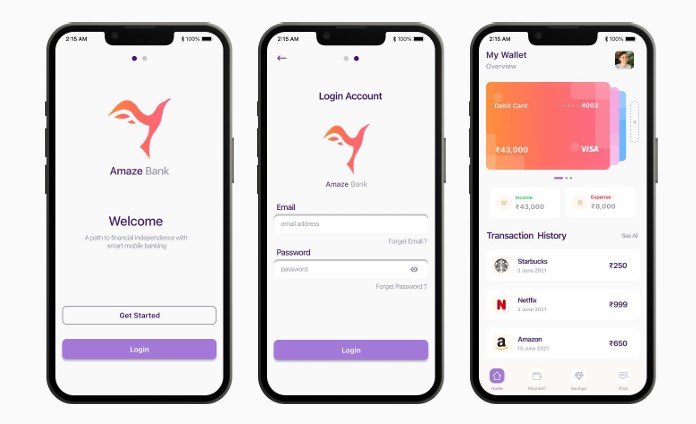

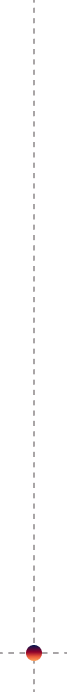

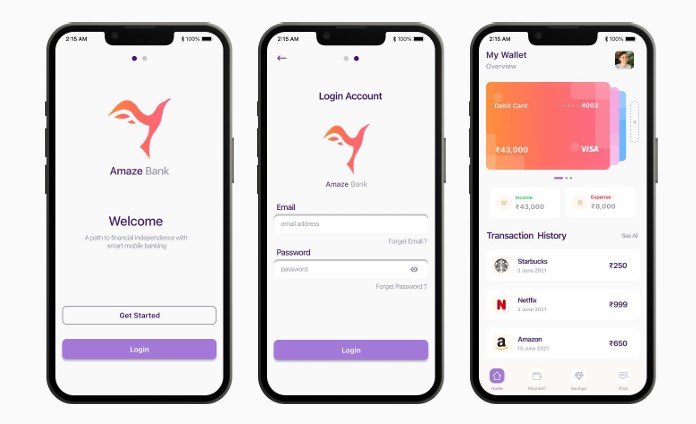

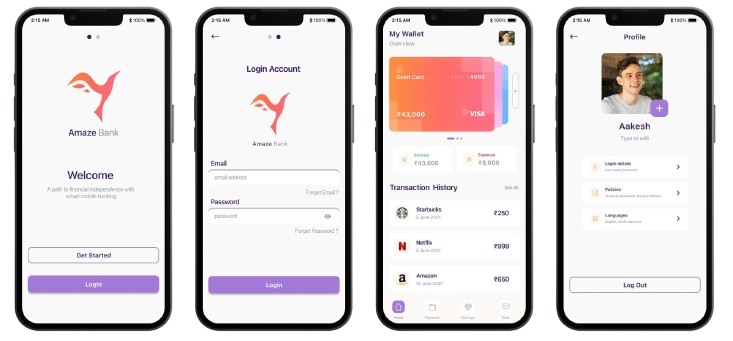

Onboarding

To commence your journey with our application, please download it from your preferred app store. Existing users can seamlessly log in by entering their credentials. For those new to our platform, selecting the “Get Started” option will guide you through the account creation process, enabling you to unlock a suite of features designed to enhance your financial management experience. Once registered, you will gain access to a personalized dashboard tailored to meet your needs, along with a host of tools and resources that empower you to take control of your financial future.

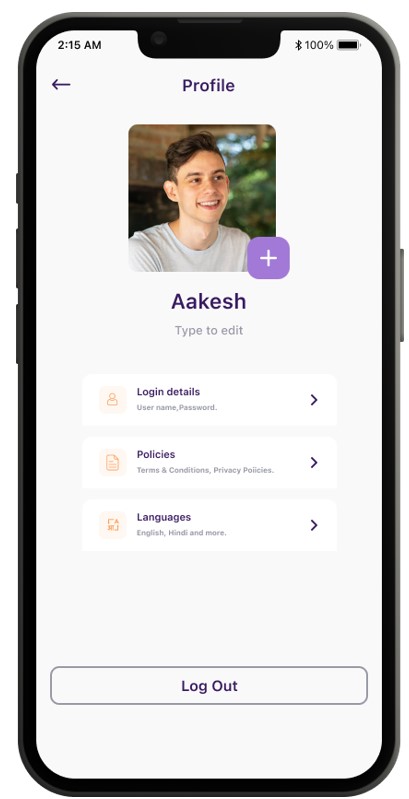

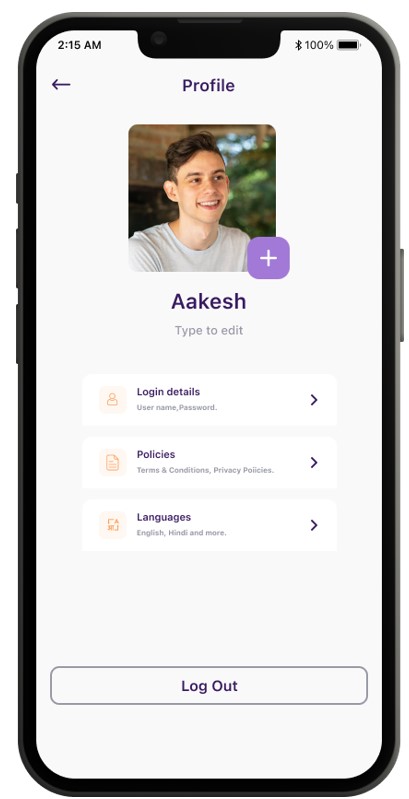

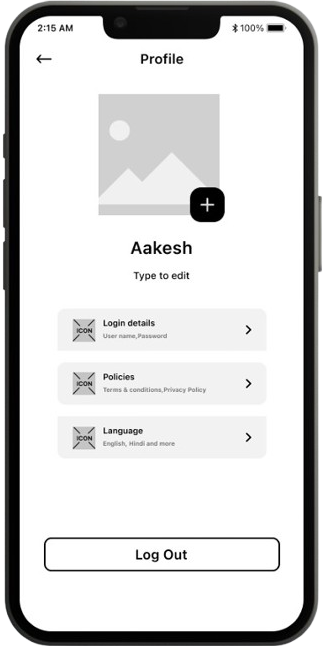

Profile Setup

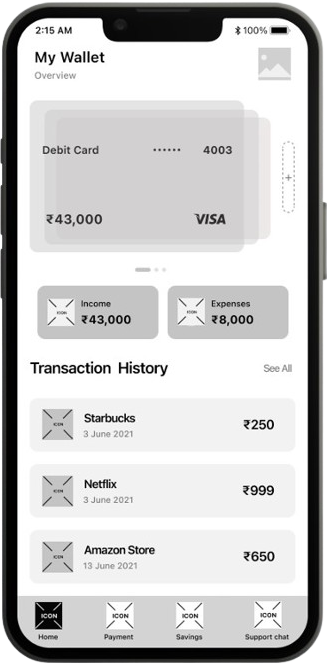

Add Multiple Cards

Financial Overview

Transaction History

Profile Setup

Add Multiple Cards

Financial Overview

Transaction History

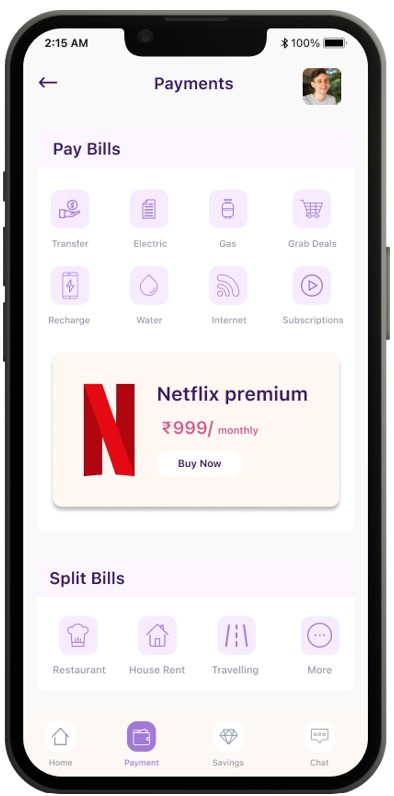

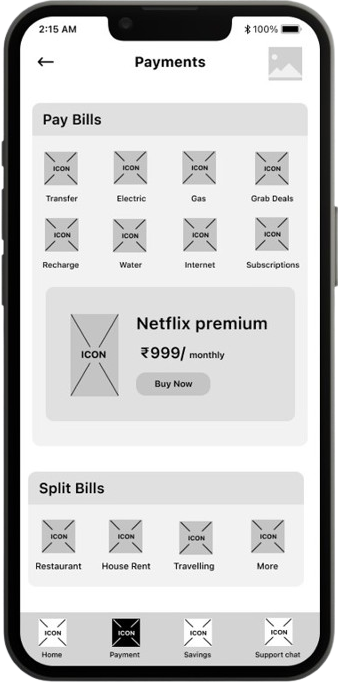

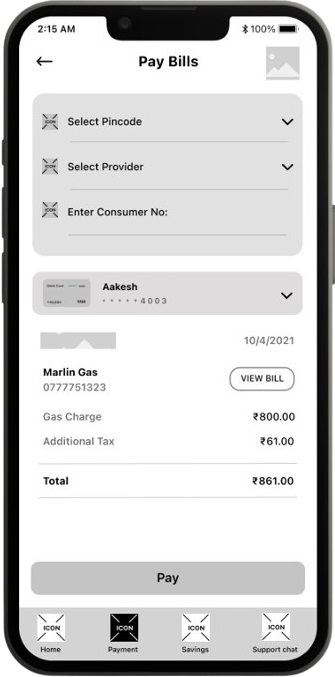

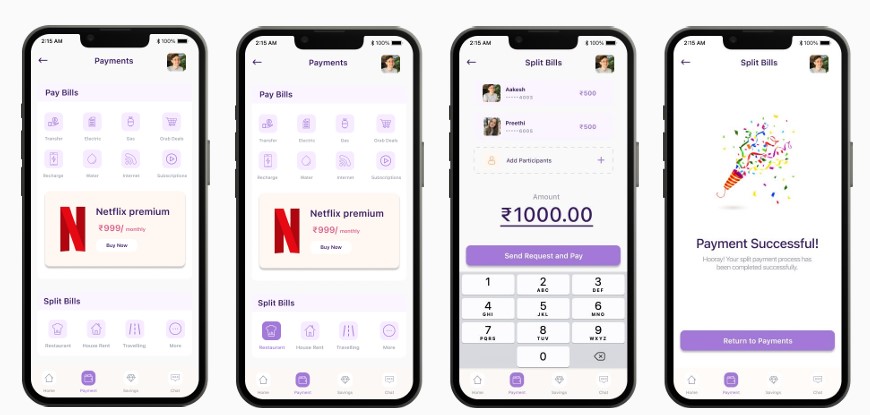

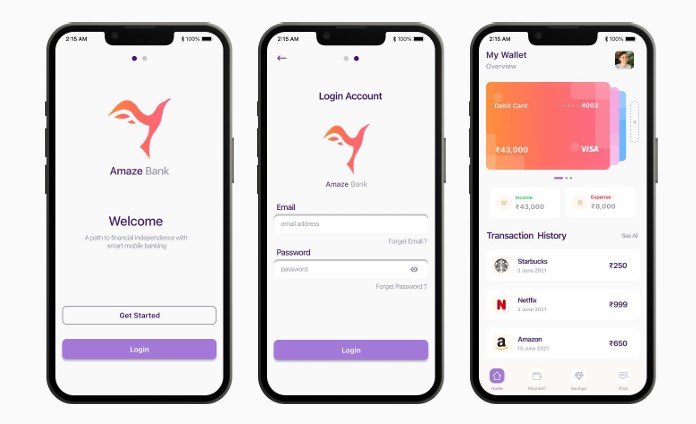

Utility Bills

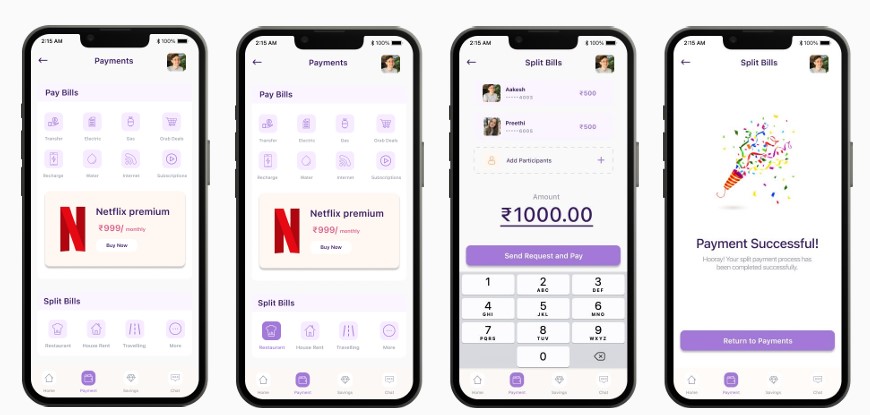

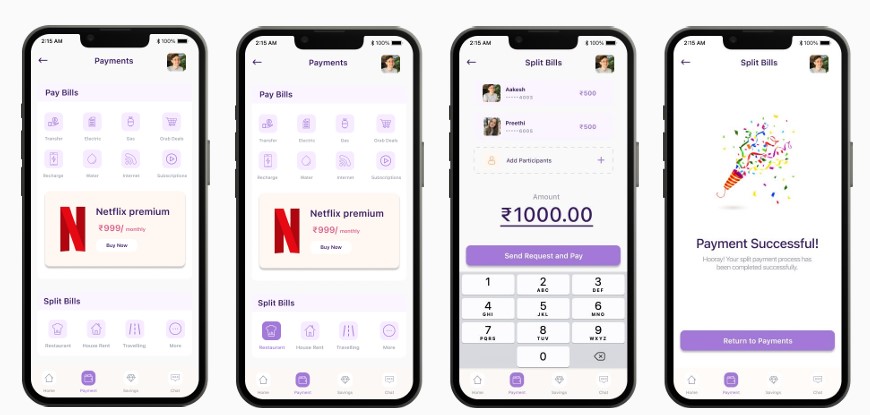

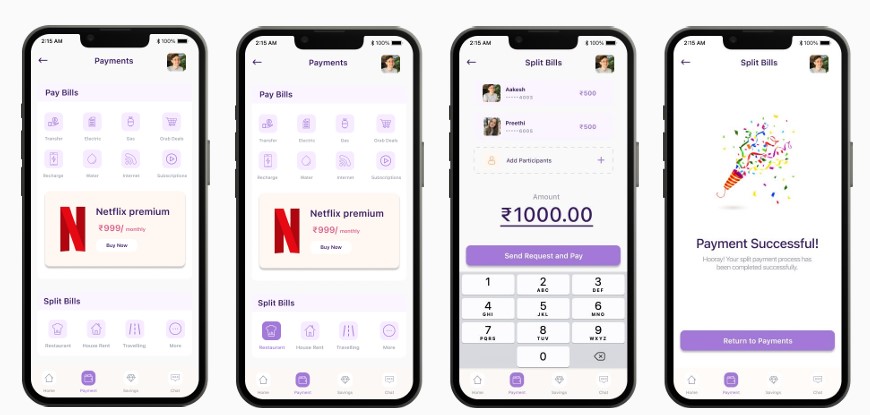

Leverage the “Pay Bill” option for the streamlined management of utility payments, ensuring the timely settlement of essential expenses.

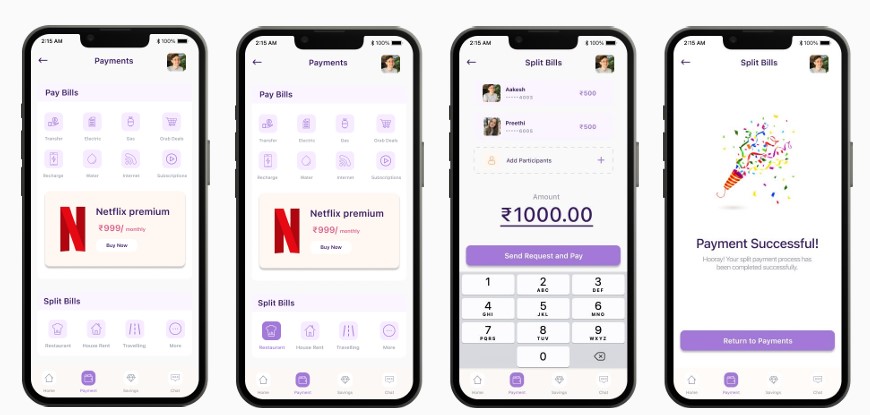

Split Bills

Easily apportion expenses among multiple parties through the “Split Bill” feature, thereby simplifying the cost-sharing process.

Exclusive Deals

Delve into a curated selection of exclusive offers on digital entertainment applications, enhancing user experience and presenting opportunities for significant savings.

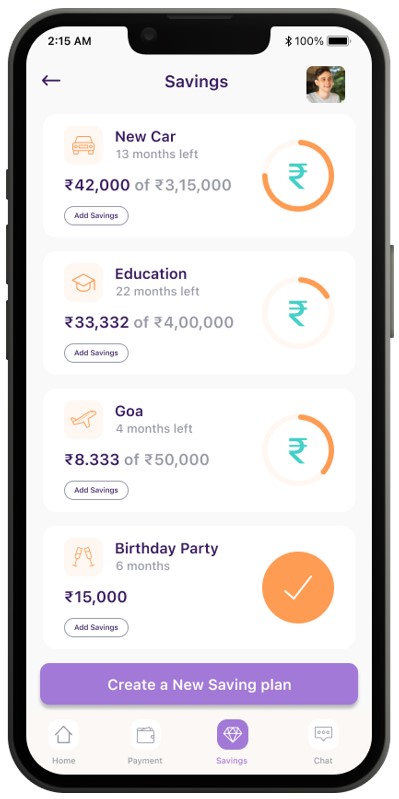

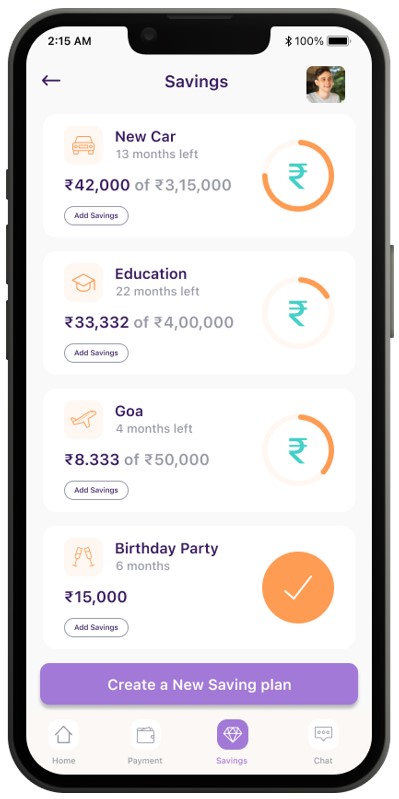

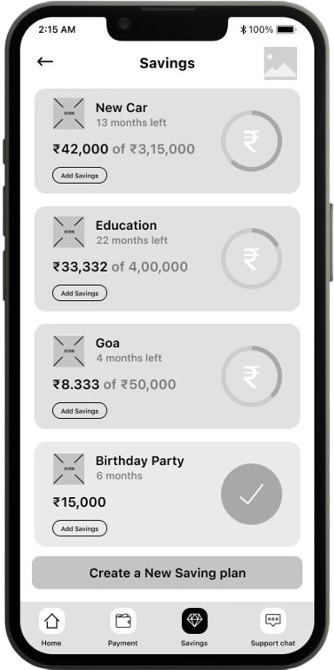

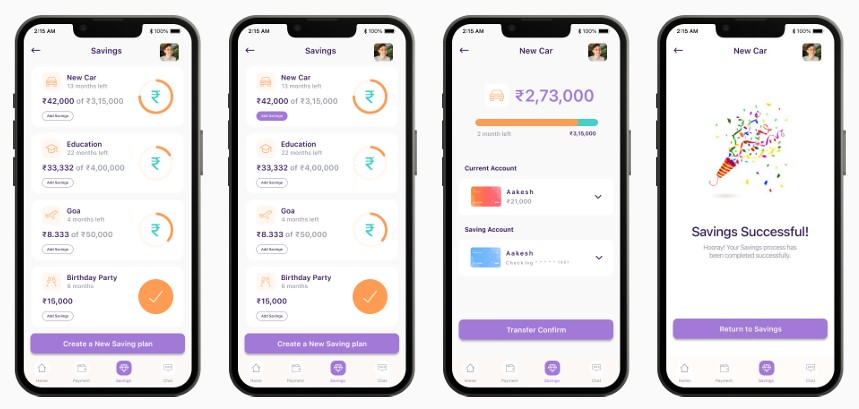

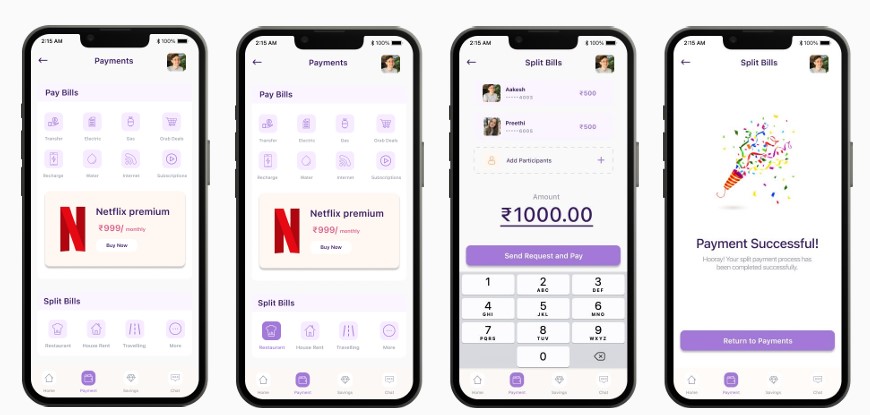

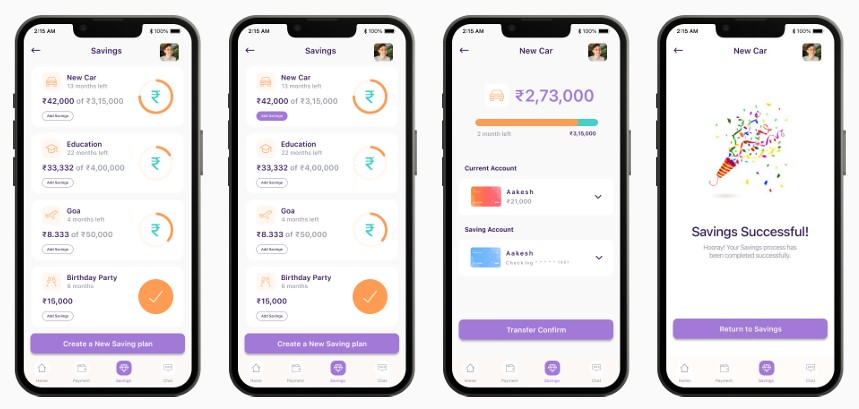

Savings

Capitalize on our robust savings features to create and manage tailored saving plans, empowering users to effectively achieve their financial objectives.

Create Savings Plans

Users possess the ability to formulate new savings plans, meticulously tailored to align with their distinct financial objectives.

Progress Tracking

Track the duration and advancement towards the realization of savings goals, offering essential insights into your financial trajectory.

Flexible Contributions

Seamlessly contribute to your savings at any time, enabling you to capitalize on emerging opportunities as they present themselves.

Create Savings Plans

Users possess the ability to formulate new savings plans, meticulously tailored to align with their distinct financial objectives.

Progress Tracking

Track the duration and advancement towards the realization of savings goals, offering essential insights into your financial trajectory.

Flexible Contributions

Seamlessly contribute to your savings at any time, enabling you to capitalize on emerging opportunities as they present themselves.

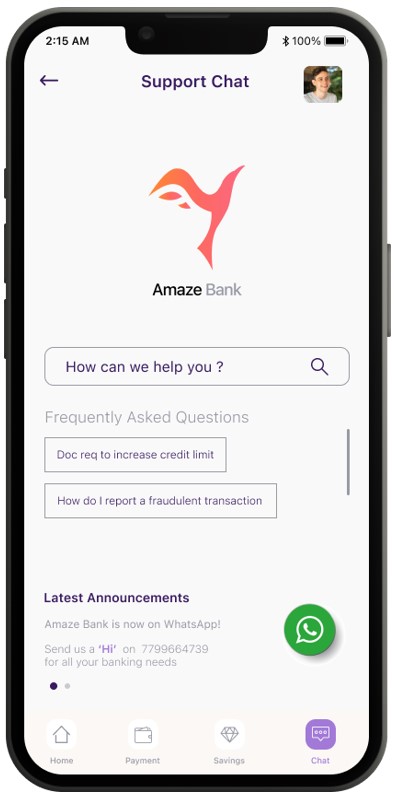

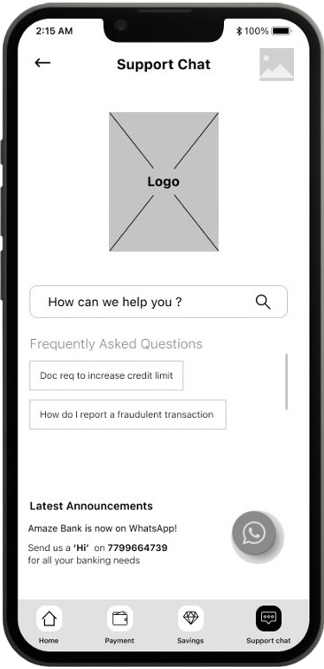

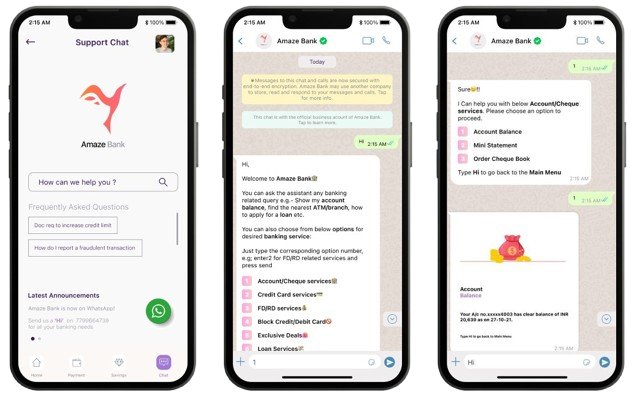

Search Functionality

Users can adeptly navigate their inquiries through the search bar, enabling swift access to pertinent information.

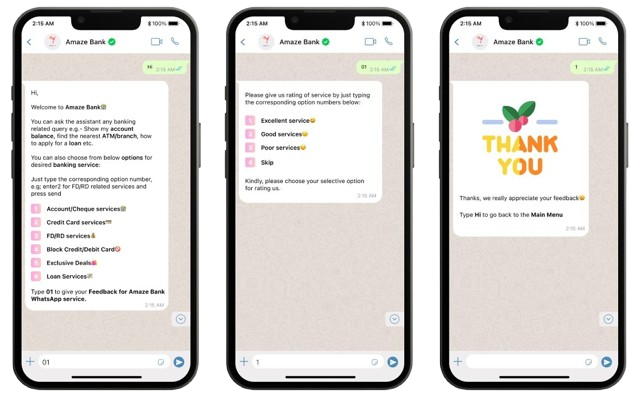

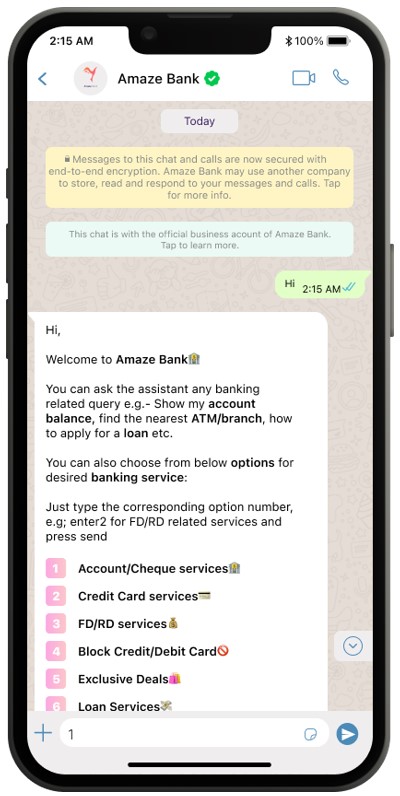

WhatsApp Integration

Establish a direct connection to our WhatsApp service page with a single click, guaranteeing prompt assistance and support as required.

UX WireFrame

This wireframe outlines the application’s key features and functionalities.

MOOD BOARD

SUMMARY OF FINDINGS

Task 1:

Onboard into the App

While using Payment option the users are very clear about the option offer for using them and liked the Individual and Sharing Payment feature as their where finding difficulty in paying bills with individual apps for Utility bill payments

Task 2:

Pay your Utility Bills

While using Payment option the users are very clear about the option offer for using them and liked the Individual and Sharing Payment feature as their where finding difficulty in paying bills with individual apps for Utility bill payments

Task 3:

Split the Restaurant Bill

Most User found out very easy with Get Started, Log In and Dashboard stage as where finding difficulty in knowing their balance in their cards of bank application

Task 4:

Add Savings for New Car

While using Payment option the users are very clear about the option offer for using them and liked the Individual and Sharing Payment feature as their where finding difficulty in paying bills with individual apps for Utility bill payments

Task 5:

Split the Restaurant Bill

Normally, User’s are connecting for customer support service through call or in person but now their can easily use WhatsApp Bank Service for an instant respond. Now User’s finds very easy to have any service which can be resolved in shorter time.

MOOD BOARD

HOW THE USABILITY TEST WAS STRUCTURED

Task 1:

Onboard into the App

Task 2:

Pay your Utility Bills

Task 3:

Split the Restaurant Bill

Task 4:

Add Savings for New Car

Task 5:

Split the Restaurant Bill

SUMMARY OF FINDINGS

Task 1:

Onboard into the App

While using Payment option the users are very clear about the option offer for using them and liked the Individual and Sharing Payment feature as their where finding difficulty in paying bills with individual apps for Utility bill payments

Task 2:

Pay your Utility Bills

While using Payment option the users are very clear about the option offer for using them and liked the Individual and Sharing Payment feature as their where finding difficulty in paying bills with individual apps for Utility bill payments

Task 3:

Split the Restaurant Bill

Most User found out very easy with Get Started, Log In and Dashboard stage as where finding difficulty in knowing their balance in their cards of bank application

Task 4:

Add Savings for New Car

While using Payment option the users are very clear about the option offer for using them and liked the Individual and Sharing Payment feature as their where finding difficulty in paying bills with individual apps for Utility bill payments

Task 5:

Split the Restaurant Bill

Normally, User’s are connecting for customer support service through call or in person but now their can easily use WhatsApp Bank Service for an instant respond. Now User’s finds very easy to have any service which can be resolved in shorter time.

User’s can get amazing deals With our App as their can have Cashback and Subscription.

User’s can have their Financial stability without any frustration about loss of money when their needed for their future plans.

User’s can have Instant service on WhatsApp Bank services of Amaze application as their can get rid of calls and In person communications.

UI DESIGN

LANDING PAGE, LOGIN, DASHBOARD AND PROFILE

PAYMENT, PAY BILLS AND PAYMENT SUCCESSFUL

PAYMENT, SPLIT BILLS AND PAYMENT SUCCESSFUL

SAVINGS, ADD SAVINGS AND SAVINGS SUCCESSFUL

SUPPORT CHAT SERVICE AND WHATSAPP SERVICE

SUPPORT CHAT SERVICE AND WHATSAPP SERVICE